Have you ever dreamed of owning a home? Maybe you will see a house and think about the great deal you could get. Buying a foreclosed home might be that deal. It can seem like a secret path to a cheaper property. But it is a path with its own twists and turns.

In this guide, we will show you the way and explain everything simply. So, if you want to know how can I buy a foreclosure home, you are in the right place.

Let’s walk through the process together, step by step.

What Does It Mean When a House is in Foreclosure?

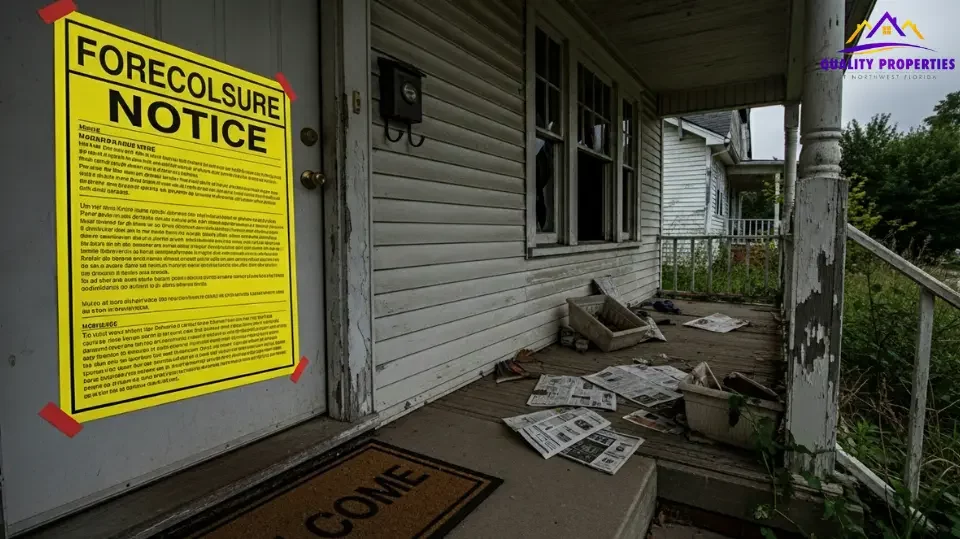

Firstly, let’s discuss the meaning of the term “Foreclosure”. Someone purchases their home by taking out a loan from the bank. They make a promise to the bank to pay it back each month. However, a case of “life happening” is likely to occur. The person may lose their job and thus be unable to make the payments. The bank can repossess the house if the owner has not made too many payments. It is foreclosure. The bank wants to sell the house to recoup the money it lent out. In this way, you are given a chance to buy it, often at a lower price than the other houses.

The Three Main Ways to Buy a Foreclosure

Foreclosed properties are not sold in just one way, and you can buy them at different stages. These three stages are completely different from each other regarding the process.

First, these stages help you figure out the most suitable method for answering the question of “how can I buy a foreclosure home?”

1. Buying a Pre-Foreclosure Home

This is the earliest stage. The homeowner has missed payments. The bank has told them they will start the foreclosure process soon. But the homeowner still legally owns the house. You can sometimes buy the house directly from them. This is a core part of the pre-foreclosure homes buying guide.

The good part is you can talk to the owner. You might be able to see inside the house and get it inspected. There is less competition. The tricky part is the owner owes the bank money. You must offer enough to cover their loan. The sales also need to happen fast to stop the bank from taking over. It’s a race against time.

2. The Excitement of a Foreclosure Auction

If the owner cannot sell the house, it goes to a public sale. This is the foreclosure auction. These are often held at a local courthouse or online. This is where you might hear about buying a house at auction. The house is sold to the person who bids the most money.

The big draw here is the potential for a very low price. But it is also very risky. You usually cannot see inside the house before you bid. You have to buy it “as-is.” This means you get it with any problems it has. There could be a leaky roof or a broken furnace. You also need to have a lot of cash ready. Most auctions require you to pay right away with a cashier’s check. This is a key step in how to purchase a house at auction.

3. Buying a Bank-Owned Property (REO)

What happens if nobody buys the house at the auction? The bank takes ownership. Now it is a bank-owned home. This is also called an REO, which stands for Real Estate Owned. These bank-owned homes for sale are listed by the bank, usually with a real estate agent.

This is often the safest way for someone new to this process to buy a foreclosure. The bank usually clears up any other loans or legal claims on the property. You can often inspect the house. You can also get a regular home loan, like the ones used for buying foreclosures with FHA loans. The process is much closer to a normal home sale. The downside is that banks can be slow to respond to offers. The price might also be closer to market value compared to an auction. This is the main difference in the foreclosure auction vs bank-owned debate.

Your Step-by-Step Foreclosure Home Buying Process

Feeling ready to start? Here is a simple plan to follow. This is your guide to buying homes that are foreclosed.

First, get your money in order. If you need a loan, get pre-approved by a bank. This shows sellers you are a serious buyer. If you plan to go to an auction, you will need cash.

Second, start looking for homes. This is how to find foreclosure listings. You can look on special websites that list foreclosed homes. Government agencies also have government foreclosure properties for sale. A real estate agent who knows about foreclosures can be a huge help.

Third, do your homework on any property you like. Look up its history. Find out if there are any other debts attached to it. This research is a vital part of the steps to purchase a foreclosure property.

Fourth, try to see the house. This is not always possible at an auction. But for pre-foreclosures and bank-owned homes, you should always try.

Finally, make your offer or bid. Be smart about it. Do not get caught up in the excitement and pay too much. Stick to your budget.

Is Buying a Foreclosure a Good Idea?

This is a big question. The answer is maybe. It depends on you. Is buying a foreclosure a good idea for someone who is handy and can fix things? Yes, it could be a great idea. You could get a home for a low price and fix it up. It builds value right away.

But it can be a bad idea for someone who wants a move-in ready home. These houses often need a lot of work. Unexpected repairs can cost thousands of dollars. It takes patience and extra cash. If the process seems too complex, consider a direct sale with Quality Properties of Northwest Florida LLC for a simple, cash offer. You have to be prepared for the risks.

Top Foreclosure Home Buying Tips

Want to succeed? Here are some simple tips.

- Work with an expert: Find a real estate agent who has experience with buying a house in foreclosure. They know the process.

- Expect repairs: Almost all foreclosed homes need some work. Have a savings account ready for these costs.

- Get a title search: This is very important. A title search makes sure the property has no hidden legal or money problems.

- Stay calm: Whether you are at Florida foreclosure auctions or making an offer to a bank, stay calm. Do not let emotions guide your decisions. This is how can I buy a foreclosure home smartly.

How Long Does Foreclosure Buying Take?

People often ask, how long does foreclosure buying take? It really depends on the type of sale. An auction is the fastest. You can own the home the same day you bid. A bank-owned home purchase is more like a typical sale. It might take 30 to 60 days to close. A pre-foreclosure is the most unpredictable. It could take weeks or months. It all depends on the homeowner and the bank.

This guide to buying foreclosed homes shows it’s a journey with different speeds. Knowing this helps you plan. If you are looking for a simple and quick way to get into a new property, you can always reach out to a company like Quality Properties of Northwest Florida LLC to see what they can offer.

Final Words

You can do it with good research, a solid plan, and a little bit of courage. It is a path that can lead to a wonderful home at a great price. It is not an easy road, but it can be a very rewarding one. From understanding what is a foreclosure auction to searching for foreclosure homes for sale, you now have the knowledge to get started. Good luck with your home buying adventure.

FAQs

Can I get a normal mortgage for a foreclosed home?

Yes, you often can, especially for bank-owned (REO) homes. It is treated much like a standard home purchase. For auctions, however, you usually need to pay with cash or a cashier’s check on the spot.

What are the biggest risks of buying a foreclosed home?

The two biggest risks are the property’s condition and hidden liens. Since many foreclosures are sold “as-is,” you may not know about costly repairs until after you buy. A title search can help find liens, which are claims against the property for unpaid debts.

How much cheaper are foreclosed homes?

The discount can vary a lot. Some homes sell for just a little below market value, while others might sell for much less. According to ATTOM Data Solutions, the average discount can range from 10% to 20% or more, depending on the market and the property’s condition.

Do I need a real estate agent to buy a foreclosure?

You do not have to, but it is a very good idea. An agent experienced in foreclosures can help you find listings, navigate the complex paperwork, and give valuable advice. This is a key part of our first-time buyer guide to foreclosure homes.

What happens to things left inside a foreclosed home?

Technically, the personal belongings left behind still belong to the previous owner. You may need to go through a legal process to have the items removed or to store them for a period. This can be an unexpected hassle and cost for new buyers.