An escrow waiver lets you pay taxes and insurance on your own. It can lower your monthly bill. It also shifts work and risk to you. Some loans do not allow it. Some loans allow it only when you meet set rules. Read on for a clear path and information.

“A creditor may not extend a higher priced mortgage loan unless an escrow account is established.” Consumer Financial Protection Bureau.

Need to sell with speed and less stress? Quality Properties of Northwest Florida LLC can give a quick cash offer.

What is an escrow on a mortgage?

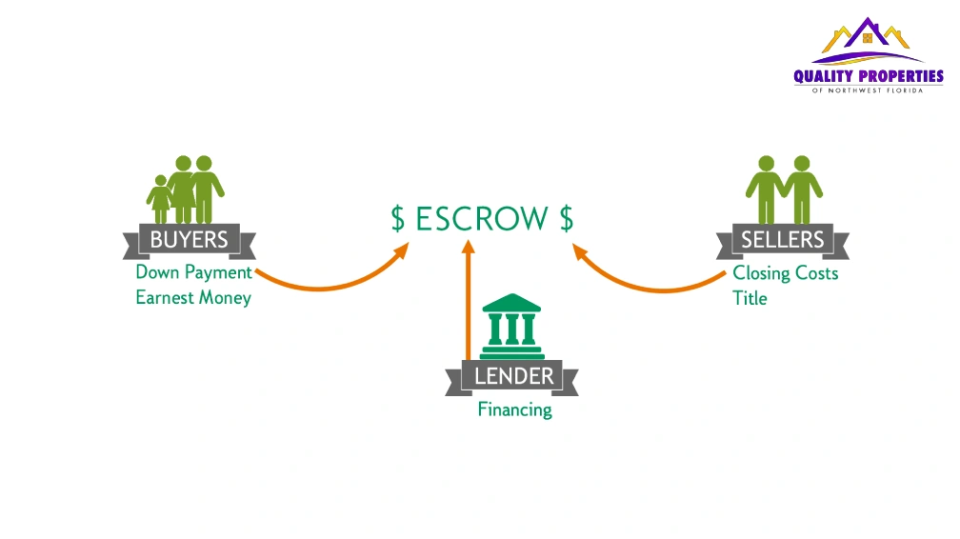

Escrow on a mortgage is a separate account your servicer uses to hold money for taxes and insurance. Each month, a part of your payment funds that account. The servicer pays the bills when due. That protects the home and the lender.ons of keeping escrow

What is escrow in mortgage payment?

In real estate your mortgage payment often has four parts. Principal. Interest. Taxes. Insurance. The last two are the escrow items. The servicer collects one twelfth of the yearly cost each month. Then the servicer pays the bills when the statements arrive.

What is an escrow waiver?

An escrow waiver means you do not use that monthly escrow account. You pay taxes and insurance yourself. You pay them in larger lump sums when due. Lenders can allow a waiver on many conventional loans. They keep the right to add escrow back if you fall behind.

How does escrow waiver work?

- Your monthly mortgage bill drops by the tax and insurance part.

- You must save for the big bills on your own.

- If you miss a tax or insurance bill, the servicer can step in and pay.

- If that happens, the servicer can revoke the waiver and rebuild escrow.

Escrow pros and cons

Pros of keeping escrow

- Fewer due dates to track

- Lower risk of missed bills

- Some states pay interest on escrow funds

Cons of keeping escrow

- Money sits in the account and often earns no interest

- Shortages can raise your monthly bill

Pros of an escrow waiver

- You control the cash until bills are due

- You can keep funds in a savings account

Cons of an escrow waiver

- Big bills need discipline

- A missed bill can bring fees and forced insurance

- Your servicer can add escrow back if you slip

Some states require interest in escrow funds. A recent court fight renewed that question for national banks.

Escrow Waiver Requirements

Fannie Mae allows lenders to waive escrow on many loans. The lender must use a written policy. The policy should judge more than LTV. It should judge the borrower’s ability to handle lump sum bills.

For loans already in service, the servicer may deny a waiver request if you had any delinquency in the past year. A sixty-day delinquency in the past two years can also block it. A waiver can be denied if the principal balance is at least eighty percent of the original appraised value.

Who can and cannot get one

- Conventional loans can often get an escrow waiver. Strong payment history and enough equity help. Lenders set the final call.

- FHA and USDA loans require escrow for taxes and insurance. Waivers are not allowed on those programs.

- VA loans do not require escrow by the VA. Many lenders still require it. Waivers may depend on lender policy.

- Higher priced mortgage loans must keep escrow for at least five years. That is a federal rule.

Escrow Waiver Fee and Who Pays the Escrow Fee

Many lenders charge an escrow waiver fee. A common number is zero-point two five percent of the loan amount. Some lenders price it in the rate instead. Others do not charge it. Policies vary by lender.

At closing you may also see a separate escrow or settlement fee. That fee pays the title or escrow company for handling the closing. That fee is often shared by buyer and seller. The split can vary by state and by contract.

Real Estate Escrow fees calculator with a simple formula

You can estimate an escrow payment with a simple path.

- Add your yearly property tax plus home insurance plus any mortgage insurance.

- Divided by twelve. That gives a base monthly escrow number. Online tools can help you plan and see cushions that lenders hold. Try a basic escrow fees calculator for a quick run.

Example

- Annual taxes eight thousand

- Annual insurance three thousand

- Total eleven thousand

- Monthly escrow about nine hundred seventeen dollars

How to get out of escrow?

Here is a clean path to request an escrow waiver after closing.

- Check that your LTV is eighty percent or lower.

- Make sure your last twelve months are on time.

- Gather proof of paid taxes and insurance.

- Ask your servicer for the escrow waiver form.

- Expect a review of your payment history and reserves.

- If approved, save for the next bills right away.

Servicers are told to deny a request if there was a recent delinquency or if the balance is too high relative to the original value.

Escrow Cancellation Requirements

Servicers should not solicit waivers. They can consider your request case by case. They must keep records of why they approved or denied it. If you fail to pay taxes or insurance on time, they can revoke the waiver and rebuild escrow.

State and Lender Rules that Can Block a Waiver in Real Estate

Some real estate loans fall under the higher priced rule. Those must keep escrow for at least five years. That is federal law.

What is an Allocated Waiver and Why to Be Careful?

You may see the phrase “what is allocated waiver on the web.” That phrase is not a standard US mortgage term. Some sites use it in confusing ways. Some scam reports even show checks labeled Allocated Waiver sent to owners. If you get one, do not cash it. Call your servicer on the number on your statement.

Fast checklist

- Know your LTV and your recent payment record

- Ask your servicer for their escrow waiver requirements

- Confirm any escrow waiver fee and how it is charged

- Set up auto saves for taxes and insurance

- Recheck insurance each year for price and coverage

- Watch your tax assessment and file an appeal when needed

Who pays the escrow fee at closing

The escrow or settlement fee at closing is a title or escrow company charge. Many markets split it between buyer and seller. The split can change by state and by the purchase contract. Ask your agent or closing attorney for the local norm.

Simple Real Estate Escrow Fees Calculator

Use this fast math to plan your monthly real estate escrow if you keep it.

Monthly escrow equals annual property tax plus annual home insurance plus any mortgage insurance. Then divide it into twelve. You can also test online tools that show cushions and due dates. Search for an escrow fees calculator and try one to model your year.

How to protect yourself without escrows?

- Open a high yield savings account for tax and insurance money

- Send money to that account each payday

- Put due dates on your calendar with early alerts

- Review your insurance at least once a year

- Watch your tax bill and consider appeals when values spike

Ready to move on from a hard to sell home. Get a fair cash offer fast with Quality Properties of Northwest Florida LLC.

FAQs

What is an escrow waiver in real estate?

In real estate it lets you pay taxes and insurance on your own. Your monthly mortgage bill no longer includes those amounts. Your lender can revoke it if you do not pay on time.

Is an escrow waiver the same as skipping taxes?

No. You still pay taxes and insurance. You just pay them directly to the tax office and the insurer.

What are typical escrow waiver requirements?

Clean payment history. Enough equity. Capacity to handle lump sum bills. Lender policy and federal rules still apply.

Can I get an escrow waiver on FHA or USDA?

No. Those programs require escrow for taxes and insurance.

Can I get one on a VA loan?

The VA does not require escrow. Many lenders still do. Ask your lender about a waiver.

How do I request one after closing?

Write to your servicer. Ask for the escrow waiver form. Show paid taxes and insurance. Show your on-time payments. Expect a review of your LTV and reserves.

What is the escrow waiver fee?

Many lenders charge about zero-point two five percent of the loan amount. Some do not. Always confirm the fee and the rate impact.

Who pays the escrow fee at closing?

The escrow or settlement fee at closing is often split between buyer and seller. It can vary by state and contract terms.