Are you wondering about escrow payment? It is a key component of several financial transactions in real estate, mortgages, and multiple business contracts. You would be surprised to know that it prevents fraud and mismanagement by offering a secure and impartial way to protect both sellers and buyers during a transaction.

This guide will answer a few pressing questions. What is escrow payment in real estate, how does it work, and the several types of escrow payments that can arise during transactions? No matter if you are a first-time buyer, a seller, or an investor curious about escrow, this blog will provide you with the knowledge you need.

Need to avoid fraud in real estate transactions? Get help from Quality Properties of Northwest Florida LLC who will guide you throughout the selling / buying journey, allowing you to easily handle the challenges, such as house marketing, cash sales, and escrow processes.

Escrow Payment: What You Need to Know?

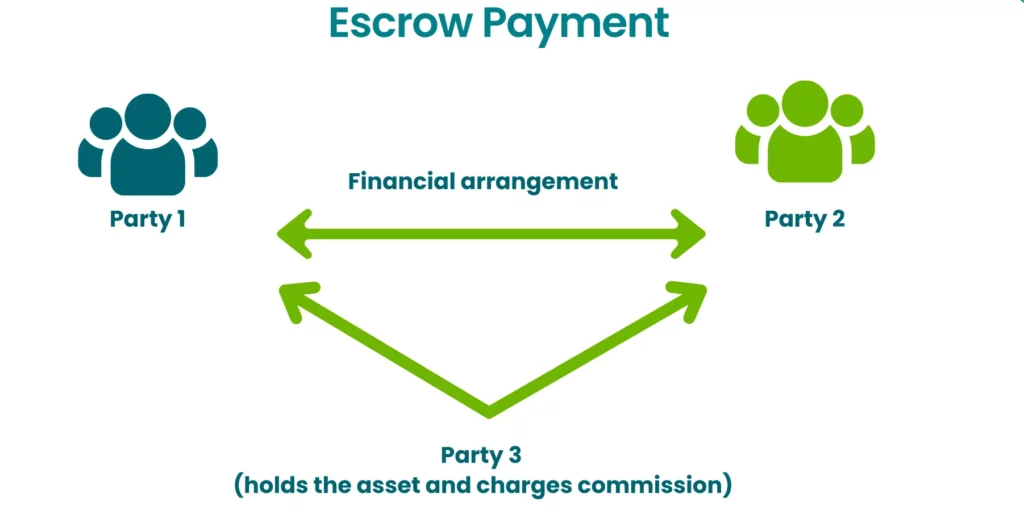

Escrow payment is a financial arrangement where a third party holds funds on behalf of sellers and buyers until the terms and conditions of the transaction are completely fulfilled. Usually applied to real estate purchases, escrow guarantees that both the buyer and seller complete their end of the bargain before the money is transferred. In mortgages, escrow payments assist in paying property taxes, homeowners’ insurance, and other associated costs.

Escrow payments are safe for both parties, in that all conditions of a transaction must be satisfied before the money passes. Escrow accounts are usually used in buying a home and refinancing, where an independent party protects the lender and the borrower’s interests.

How Does Escrow Payment Work?

What does it mean to be in escrow? An escrow payment serves as a protection mechanism in most financial deals, guaranteeing that both sides of the deal meet the conditions of the contract before releasing cash. A standard escrow situation involves the buyer depositing the funds (or a percentage of them) into escrow with a third party that will be trusted. This third party, typically a title company, real estate agent, or banker, will disburse the funds to the seller once all conditions are fulfilled.

For instance, in a home sale, the purchaser can put the payment into an escrow account. The agent in escrow will confirm that the property’s title is free, the house is inspected and passes, and the paperwork is done before disbursement of the payment to the seller.

Escrow Payment Meaning in Mortgages

Escrow payment in the mortgage industry is a bit different from real estate transactions. When you get a mortgage, your lender might ask you to open an escrow account. This account is utilized to gather monthly payments for property taxes, homeowner’s insurance, and other related expenses.

Every month, part of your mortgage payment is deposited into the escrow account. Your lender will use this account to pay for the homeowner’s insurance and property taxes on your behalf. This way, these critical costs are covered on time, and the property is insured and current with taxes.

What is Escrow on Mortgage Payment?

Escrow payment mortgage is the amount of your mortgage payment applied to taxes, insurance, and other expenses. Your monthly mortgage payment is split into two portions: one to the principal and interest, and the other to your escrow account. Money in this escrow account pays for expenses such as property taxes and insurance premiums so that these bills are paid automatically and promptly.

Knowing the split of your mortgage payment is important for keeping your finances in check and making sure your property is covered. When home values and taxes increase, it’s good to monitor escrow levels.

Escrow Reserve Payment Explained

An escrow reserve payment is the excess funds that lenders might ask for in the escrow account to pay for sudden spikes in property taxes or insurance rates. The reserve acts as a buffer, ensuring that there are sufficient funds in the escrow account in case costs go up unexpectedly.

For instance, if your property taxes rise or your home insurance premiums rise, the escrow reserve guarantees that there is sufficient money in the account to pay for these rises without interrupting your monthly mortgage payments.

Additional Escrow Payment

At times, homeowners are required to pay an extra escrow payment if their account balance is less than the amount needed. It happens when the initial estimated costs of insurance or taxes were too low, or when there are unforeseen changes in those costs.

For instance, if your premium for homeowner’s insurance goes up and the escrow account you hold is not enough to absorb the increase, the lender might compel you to pay an additional amount. It ensures that the account is adequately funded for subsequent payments.

Escrow Shortage Payment

Escrow shortage payment refers to a situation where there is insufficient cash in your escrow account to cover property taxes, insurance, or other related escrow expenses. In this scenario, the lender will notify the homeowner of this shortfall and request an additional payment to restore balance into the account.

If you fail to meet the shortage, it may result in a penalty or your late payment of property tax or insurance. Moreover, your lender may increase your monthly mortgage payment to cover the shortage in the long term.

Role of Escrow in Real Estate Transactions

In property sales, escrow ensures that the seller and buyer fulfill their part of the contract before the transaction is finished. The buyer deposits the purchase amount in an escrow account, and the seller is to fulfill all conditions (transfer of ownership, property inspections, and repairs) before disbursing the money.

This unbiased third-party involvement minimizes risk for seller and buyer alike and guarantees the free flow of the transaction. Escrow accounts in real estate also deter disputes and guarantee money release only upon completion of all conditions of the contract.

Avoid These Mistakes While Processing Escrow Payment

Homeowners should know these common mistakes that could complicate the process. Here is the list of such flaws.

- Poor Tracking of Escrow Payments

Always monitor your escrow account to ensure there are enough funds to cover taxes and insurance.

- Inability to Handle Escrow Shortages

When you come to know about an escrow shortage, you must address it quickly to avoid delays or penalties.

- Underestimating Escrow Cost

You need to plan for a possible increase in property taxes or insurance rates that could impact your escrow payment.

Final Words

What is escrow payment and how does it function in both mortgage payments and real estate transactions? Understanding this can make a world of difference in your financial planning. You will be better equipped to navigate financial obligations and ensure your assets remain protected by exploring the importance of escrow, including the different types such as escrow reserve payments, additional payments, and escrow shortages,

Whether you are a repeat buyer or a first-timer, escrow is an important way to keep your money safe, ensuring that your insurance and property taxes are paid timely and without hassle.

Still curious about escrow payment? Contact Quality Properties of Northwest Florida LLC to get a free consultation now.

Frequently Asked Questions

How to open an escrow account?

For this you need to sign an agreement with an escrow agent (bank or licensed realtor) and deposit funds/assets. Now the agent holds or releases the funds as per the defined terms and conditions outlined in the agreement.

What is the role of an escrow account in a mortgage?

It helps keep up with regular bills such as property taxes, homeowners’ insurance, and occasionally mortgage insurance. Rather than having the homeowner pay these bills, the lender gathers these fees every month with the mortgage payment and forwards them to the homeowner.

How is escrow used in real estate transactions?

In real estate transactions, escrow guarantees both the buyer and seller fulfill their terms of agreement prior to completing the deal. The buyer makes a deposit to an escrow account, and the money is disbursed to the seller as soon as all conditions, like title transfer and inspections, are met.